On the 1st of February, 2022, a Virtual workshop “Energy sector and the opportunities for Public-Private Partnership” took place.

The workshop was orginised by the Ministry of Economy of Ukraine, together with the SO “PPP Agency” and with the support of the International Finance Corporation (IFC) and the Public-Private Infrastructure Advisory Facility (PPIAF) to facilitate the development of the PPP mechanism in the energy sector and to increase the institutional capacity of PPP project initiators from the public sector.

The workshop was opened by Oleksandr Hryban, Deputy Minister of Economy of Ukraine and Filip Drapak, Senior Energy Expert of the International Finance Corporation (IFC).

Filip Drapak has greeted the participants and stated that for the International Finance Corporation (IFC) the development of the energy sector of Ukraine is of critical importance.

Oleksandr Hryban has thanked the participants for joining the webinar and noted:

“The implementation of the PPP projects, involving the production of energy from renewable sources will facilitate the development of the energy sector, as such projects are aimed at the transition to the production of clean energy. It is possible due to the expansion of the power grid’s capacity to integrate energy produced by the private sector from renewable sources, which, in turn, will further the decarbonization of the whole energy sector.

In 2035, 80% of primary energy will be supplied by the three main energy sources – natural gas, nuclear energy and renewable energy sources, with the last constituting 25%. This is stipulated by the Energy Strategy of Ukraine.

I am grateful to the consultants and experts of the IFC and PPIAF for their ongoing support of the initiatives of the PPP Agency as well as for the opportunity to study international experience in implementing projects in this field. I am certain that practical examples, presented during the workshop, will facilitate the initiation of new PPP projects in Ukraine and contribute to the high quality of their preparation and structuring.

The key speaker of the first section of the workshop was Bernard Atlan, Principal Investment Officer of the International Finance Corporation (IFC).

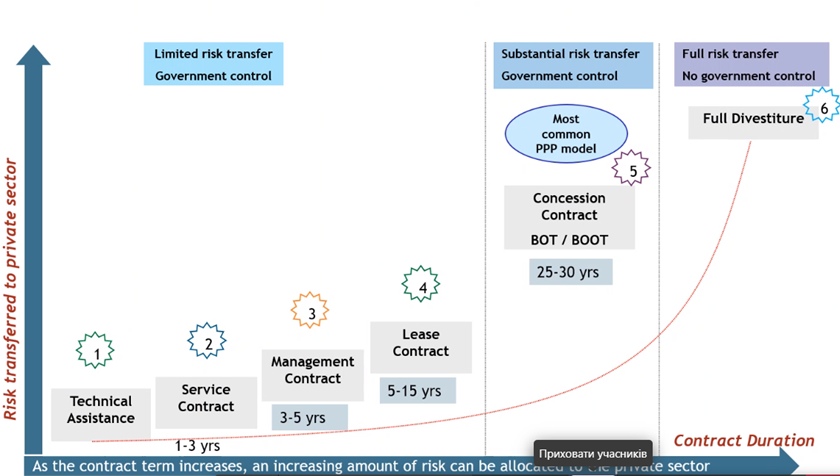

Bernard Atlan has explained six main ways (models) of private sector participation in the development of energy infrastructure and capacities, depending on the level of risk transfer to the private sector. The most common PPP models in this sector are build-operate-transfer (BOT) та build-own-operate-transfer (BOOT).

The International Finance Corporation (IFC) expert has explained the advantages of financing projects by a private partner. Thus, even though the financing cost (including the cost of raising funds) might be higher, compared to traditional procurement methods, the value for money, in general, is higher, due to lower capital and operating costs. Projects implemented by the public sector are statistically more likely to face cost and time overruns, compared to the implementation under the PPP model, when risks of construction delays and operational risks are transferred to the private partner.

Bernard Atlan has emphasized the importance of a comprehensive approach to project solutions, that involve private funding. Considering that the energy system works by balancing consumption and production in real-time, the introduction of new capacities like solar generation, the volume of production of which cannot be regulated, makes their integration challenging. Therefore, design solutions must synergistically combine generation capacities with technologies that facilitate the integration of generated electricity into the grid (storage, highly manoeuvrable capacities).

The next speaker was Filip Drapak, Senior Energy Expert of the International Finance Corporation (IFC), who has discussed trends in the energy sector with a focus on solar generation.

According to him, the following trends have emerged over the last several years: decarbonization of energy; increase in the amount of energy produced from renewable energy sources (RES) and decrease in the price of generating energy from RES; grid and market operation support; short term and long term storage of energy; and also the implementation of new, “green” technologies.

Filip Drapak has described three main mechanisms of procuring energy produced from RES:

I) feed-in tariff,

II) capacity auction,

III) site-specific auction.

The expert has advocated for giving preference to the last two options. Capacity auctions are more suitable for countries with a developed market and good price understanding, while site-specific auctions are well-suited for pilot PPP projects. Site-specific auction implemented under the PPP model envisages the public partner to provide land, a long-term offtake agreement, a connection agreement and a transformer capacity at the transmission point (if needed/possible). This mechanism results in high competitiveness, global competition, high comparability of bids and an opportunity to get the best price.

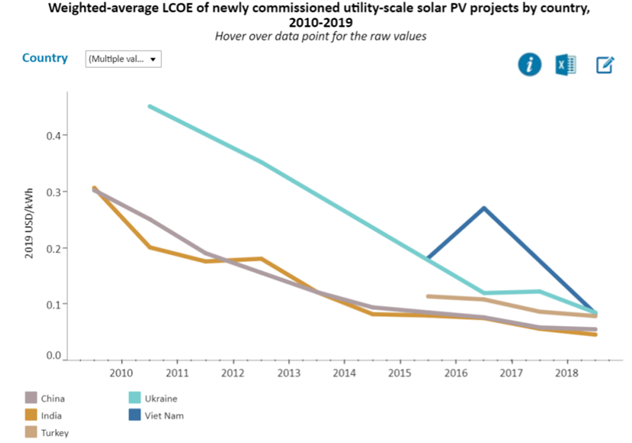

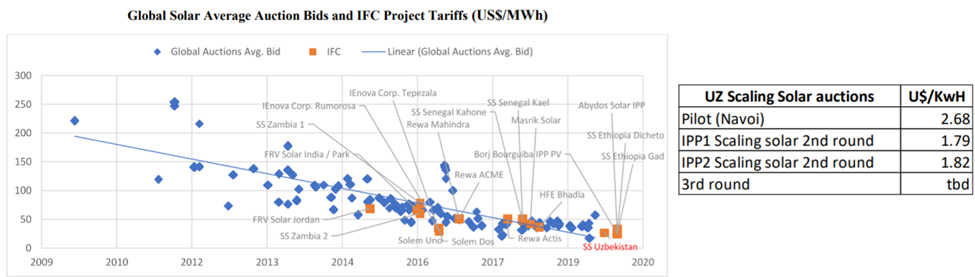

In general, the analysis of trends in the energy sector proves that solar photovoltaic power generation is on the rise. At the same time, solar energy generation becomes increasingly cheaper by the year, which is described schematically below.

Solar energy is capable of attracting private sector investments, as the private sector can handle construction and operational risks better and also for the reason that there are very successful global models of procurement on the bases of long term offtake contracts enabling governments to achieve the power production without using its own balance sheet.

Another trend is the improvement of economic feasibility in solar generation projects. The cost of solar power per installed kW has fallen down to one fourth against 4000 USD per kW prior to 2010 to below 1000 USD per kW at the end of 2019. The technical parameters of solar photovoltaic panels are improving steadily as well. The capacity factor of panels has reached over 20 percent and producers of solar panels are now willing to guarantee performance for 25 years of the panel lifecycle.

Solar has become competitive in terms of costs with traditional electricity producers. While wind has been typically cheaper than solar, the solar panels’ cost decline is quicker therefore dominance in price against the wind may be expected soon.

Solar energy has been the most innovative part of renewable development driving the new technologies in terms of lower cell cost, higher cell capacity factor and efficiency and ultimately solar-related technologies including batteries, smart grids etc.

New and emerging technologies also include new ways of the integration of solar production to other infrastructure without the usage of useful land:

– Floating solar power plants to be floated on large water,

– Building-integrated photovoltaics to be used in the construction industry,

– Photovoltaic traffic noise barriers.

Filip Drapak has noted that with the development of RES, particular attention should be given to the resiliency of the grid, which became one of the limitations and opportunities for renewable energy. Solar combined with batteries allows for significant improvements in the overall grid management and “smart” grid solutions. Batteries behind the meter as well as in front of the meter but placed regionally allow for new development of renewables across regions and improve the acceptability of the renewables on a global scale. Such complex solutions can be a good idea for pilot PPP project implementation in the energy sector in Ukraine.

The next speaker of the workshop was Mario Turkovic, Senior International PPP Expert of the International Finance Corporation (IFC). He has shared with the participants the Croatian experience in RES development.

Mario Turkovic told the participants that in 2019, Croatia reached 28.5% of energy from RES in its gross final energy consumption in 2019 (around 50% goes to electricity) surpassing its 20% target for 2020.

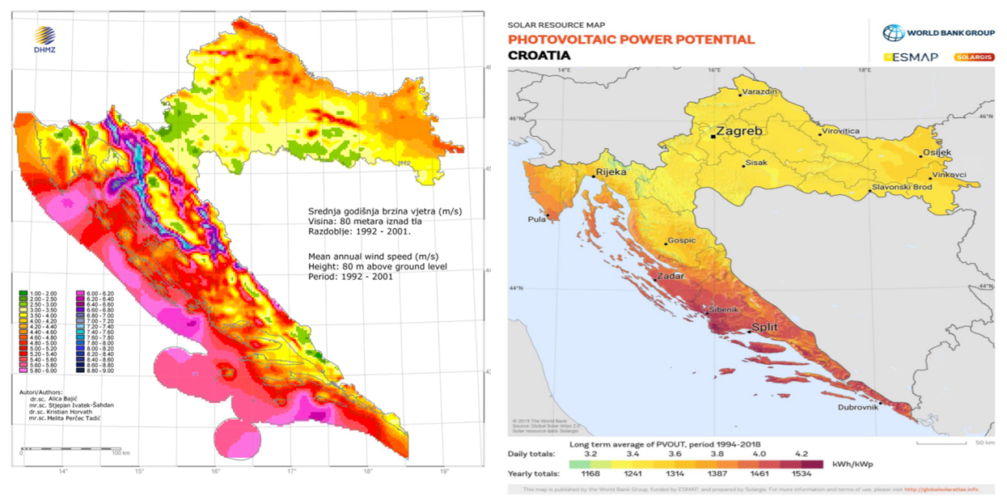

Croatia has significant wind and solar energy generation potential:

- According to different International sources, the Republic of Croatia has a potential of between the 22 and 61 GW of onshore wind capacity and 179 GW of offshore wind capacity.

- According to domestic estimations, the potential in solar is about 8 GW (including both utility-scale and integrated solar projects).

Most of the projects are focused in the four most southern counties. This puts a lot of pressure on transmission and distribution system operators to ensure that new renewable energy capacity can be added to the power grid.

At the end of 2021, the RES market in Croatia has faced a number of issues, including

- Many requests from different types of investors for the same locations,

- Grid could not absorb all requests, huge network connection costs;

- Unresolved land issues, different rules and practices for getting land rights;

- Procedural inconsistencies;

- Environmental issues.

To resolve these issues, a new legal environment was created. From now on, new projects are going to tender for getting the energy approval. Requirements for tender participation include the development of spatial plans, preliminary design, feasibility study, preliminary connection opinion by the operator and a bid bond.

Private partner financing is provided in the form of “project financing”, which means that financial organisations assess the bankability of projects as the main source of interest payments and debt repayment.

To increase projects’ potential to attract investment, the government of Croatia has established an auction-based support mechanism in which it awarded feed-in tariff (for small plants of up to 500 kW) and feed-in premium (for of above 500 kW).

Enrique Lora, Evaluation Specialist and Energy Expert of the International Finance Corporation (IFC) has presented to the participants the experience of Uzbekistan in market creation and the Scaling solar program in Uzbekistan.

Uzbekistan has one of the most energy-intensive economies in the world, the country is highly reliant on gas for electricity generation—72 percent of total electricity. In addition, with a rapidly aging supply infrastructure, the nation’s power system is burdened by low efficiency and unreliable supply. Despite investments in transmission and distribution networks, electricity losses remain relatively high, estimated at 20 percent of net generation.

Uzbekistan is a treasure trove of renewable energy resources — solar, wind, and hydropower — that can fulfill the country’s growing energy needs and help the country transition to a clean energy economy.

Adding new power generation requiring mobilization of all possible sources of funding. Public-private partnerships (PPPs) can be an effective approach to address this financing gap.

The government of Uzbekistan, with the support of the International Finance Corporation, has implemented a pilot initiative for scaling solar generation in the city of Navoi to 100 MW. The project was competitively tendered, using standard tender and contractual agreement documents (including a bankable 25 years PPA and GSA) based on the WBG scaling solar templates. It was followed by two more rounds of competitive tenders 900 MW to replicate the SS template.

The subpar development of the solar energy market notwithstanding, the tender has resulted in the establishment of record low tariffs.

In general, the Pilot initiative has furthered the long-term market transformation: the increase in access to low-cost and reliable electricity supply; the increase in private participation, including world-renowned developers; and reinforcement and improvement of a competitive market structure.

The initiative has demonstration effect and replication potential:

- diversification of Uzbekistan energy mix with low-cost generation: 2.7 GW (17% of installed capacity)

- environmental benefits (GHG emission reduction of Navoi 156,000 tCO2e/year)

The success of the PPP model serves as an example for future private sector participation in the country, while sending a positive message to the global investment community. This project sets a precedent as a commercially viable model that can be successfully replicated to attract new private players to the market.

The workshop was concluded with a discussion on the new opportunities for public-private partnerships in the energy sector in Ukraine, types of projects that can become pilot, PPP impact on the energy market, useful approaches in PPPs for RES and deliberations over the presented pilot projects implemented in Croatia and Uzbekistan.